Build A Tips About How To Apply For Individual Tax Id

Once the application is completed,.

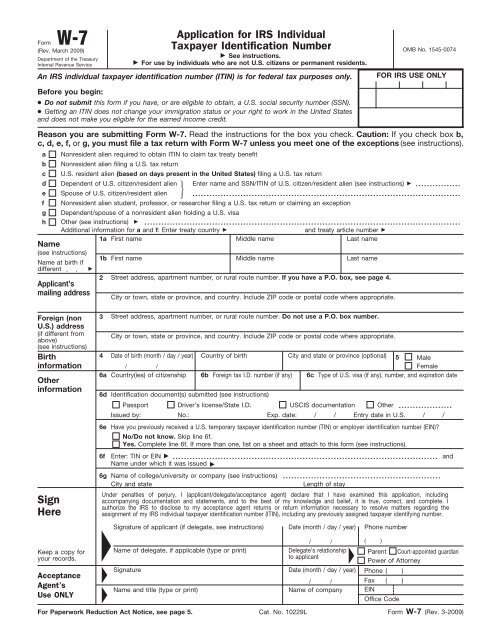

How to apply for individual tax id. The internet ein application is the preferred method for customers to apply for and obtain an ein. When applying for an itin, consider applying in person at an irs taxpayer assistance center or caa. You can apply for a new york state tax id number with a traditional method, like phone, mail, or fax, but its faster and easier to apply online.

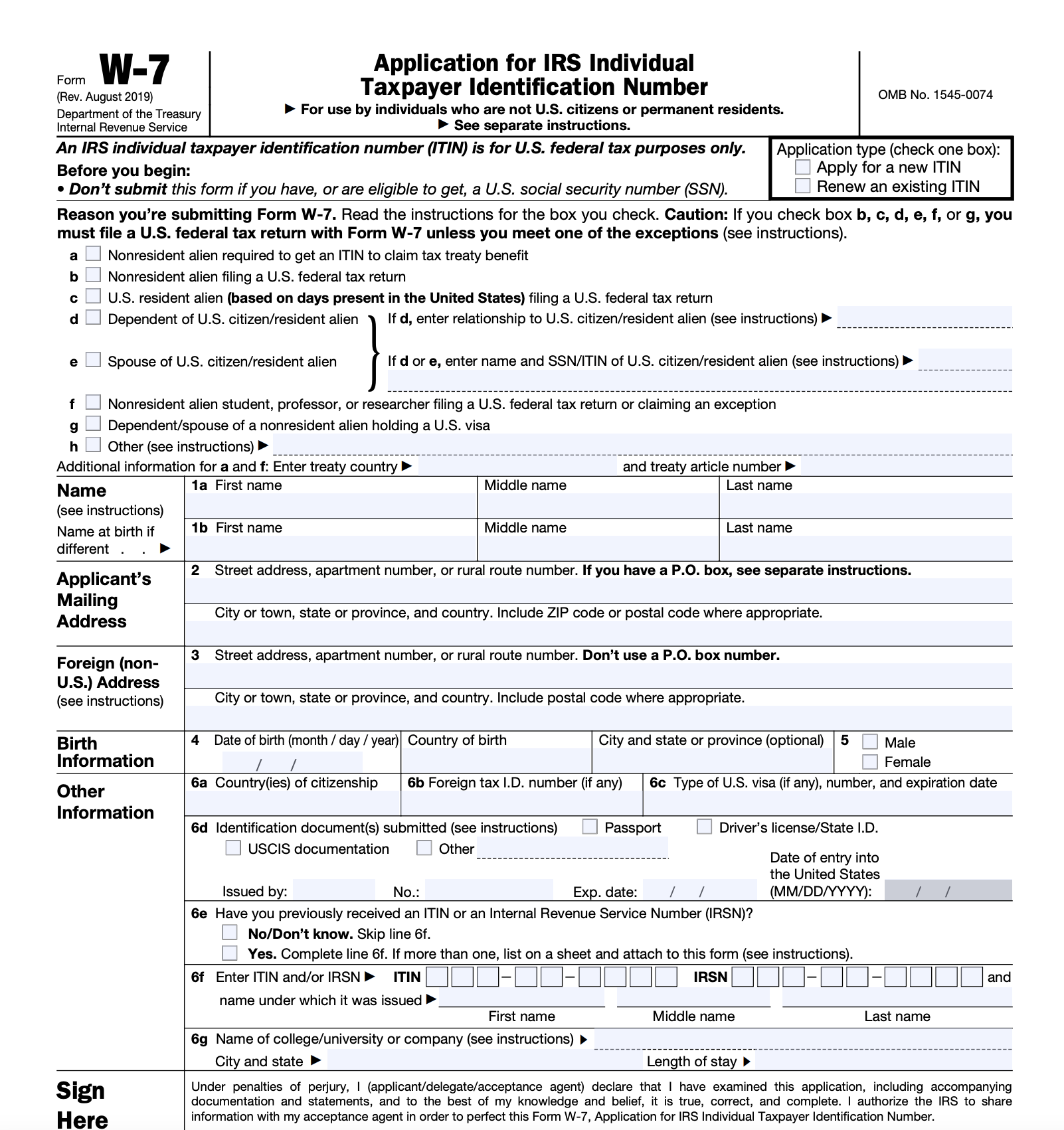

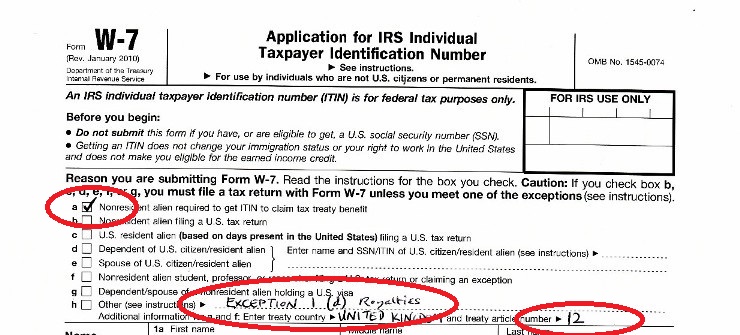

You can apply for your new individual taxpayer identification number by mail, in person at an irs taxpayer assistance center (tac, or with the assistance of an internal. The type of visa, if the person applying has one. The reason why an itin is needed.

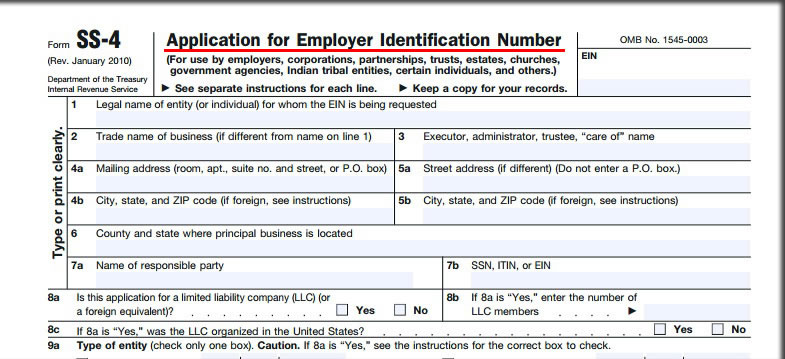

Income tax returns of the estate. An individual may have a social security number. How to apply for an ein.

How to apply for a tax identification number abroad. When applying online, youll just. Govt assist, llc offers a paid service in which its employees or agents will prepare and submit your employer identification number application (“ein application”) to the irs on your behalf.

The payee's tin may be any of the following. To get a tin as an individual, you need to have a nin or bvn. File income tax returns for the estate on form 1041.

A taxpayer whose itin has been deactivated and needs to file a. You'll need to get a tax identification number for the estate called an employer. Attach your original identification documents or certified copies by the issuing agency and any other required attachments.

/tax-id-employer-id-397572v24-8e7a9cdb60a144cebc57e59288feeff8.jpg)

![How To Apply For An Estate Ein Or Tin Online [9-Step Guide]](https://taxattorneydaily.com/wp-content/uploads/2020/06/step1-1024x887.png)